MY VIEW BY DON SORCHYCH | DECEMBER 14, 2011

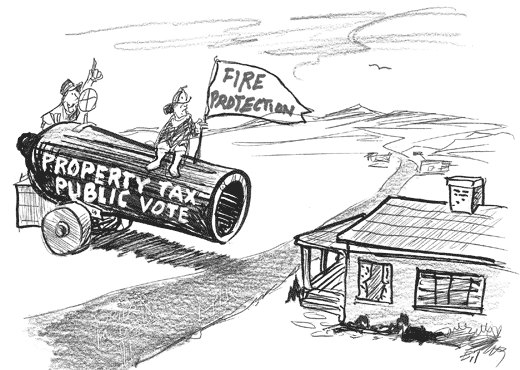

No property tax!

We go online tomorrow and I have set aside my completed editorial about my family and Christmas. Why? Because I was blindsided by a workshop about fire protection and a pending council meeting about whether to vote to have citizens decide by vote for or against a property tax to fund fire coverage.

I knew Town Manager Usama Abujbarah had been all over town asking businessmen to support a property tax. That is the mantra of many or most public officials, but it is a bureaucrat trap.

We have been there before, and the pro-property tax council members and town administration were surprised by a 4-3 vote against putting a property tax to a vote. Just so you know, those for the tax vote were Mayor Vincent Francia and Councilmen Jim Bruce and Steve LaMar. The winning heroes were Vice Mayor Ernie Bunch and Councilmen Dick Esser, Ralph Mozilo and Adam Trenk. Bless them! Mozilo and Trenk are no longer on council and the leanings of new council members Shelly Anderson and Thomas McGuire are unknown.

Now, it is true that council cannot vote up or down on a property tax. It must be voted by the citizens. All council can do is enable the vote, but they are playing with fire if any chance is given to a public vote.

Remember, the successful vote for “medical marijuana?” The public passed that law and created a nightmare, not the least of which is federal law. It passed because people who would benefit spent large sums to assure the win. People didn’t care enough to mount an opposition.

The Cardinals’ stadium is another abuse of city privileges to create a sports arena with property tax. The vote was mainly funded by those who would profit from it, at the expense of taxpayers. That is why I watch Cardinal games to see them lose.

We have a representative form of government and we count on elected officials to vote properly on our behalf. We don’t expect them to dump it on voters, where voters are fed lies and innuendo to get a positive vote. I would hope a good legislature or council would abhor a property tax as one of the worst taxes and defeat it each time it rears its ugly head by not sending it to the voters and risking a positive vote.

The workshop had about 40 attendees and was dominated by Daisy Mountain officials that apparently had been invited. Rural Metro was represented by an accounting type employed by Rural Metro.

Daisy Mountain tried here before, but the public turned away because it was funded by property tax which means your cost would be based on the assessed value of your property.

In my case I purchased a ten-acre property in the year 2000 and five acres is vacant. Rural Metro charges only $50 for the vacant land and about $1,100 for the parcel where the domicile and other buildings reside. The assessor values the home at about $605,000 and the lot at $310, 000 in 2011, even though I paid $575, 000 for both in 2000. This was the true market value. So for a property tax we would be at the vagaries of the assessor, and possibly the fire protection company. And I still could not sell my home for the assessed value.

About 25 percent of the land in Cave Creek is vacant, much of it owned by out of town owners. If there was a vote they would be denied the privilege to vote and would be getting taxation without representation. Wasn’t that what the famous Tea Party rebellion was all about?

What was offputting to hear was a person at the workshop state, since our property tax for Spur Cross Ranch would end in 2012, why not just continue it for fire protection? Well, the tax goes away, period. And if a new one was established it would be showing the big lie, established by many spokesmen of the town, which promised there would never be another.

The experience of the Daisy Mountain Fire District is instructive. They once decided to pay cash for equipment that was being purchased on a scheduled basis. This sent their property tax through the roof and may have caused great hardship to subscribers who were part of the district and had no choice.

Remember, fire districts are Maricopa County subdivisions and ruled by the board of supervisors and the fire district board, which are so illustrious that Tom Seemeyer served on a board. Need I say more?

The good thing about Rural Metro is you don’t have to buy the service. You can roll the dice and pray you don’t have a major fire. There are so few fires in Cave Creek your chances are pretty good.

Although Rural Metro is a private company, pressure should be applied to them to market their subscriptions and increase them while lowering their costs. Their responses have been pretty lame, principally that their budget isn’t large enough to sustain a sales program. Why should they when people have no choice. Rural Metro is a monopoly and can charge what they want, unless competitors promise to compete at lower costs. I would prefer to see town staff work on that rather than trying to force a property tax down our throats. Before Ralph Mozilo left council he queried, “Why the hurry? Where is the emergency?”

The town is now peddling the application of .5 percent of the current 3 percent sales tax toward fire protection and the balance of about $800,000 to a property tax. Fine except for the property tax. Apply increasing sales tax receipts to fire protection while reducing the amount subscribers pay, but no availability to non-subscribers.

Read Linda Bentley’s front page article, which is quite detailed about this issue and remember the council vote will be on Monday, Dec. 19. The council meeting convenes at 7 p.m.