I have been selling Real Estate in Arizona since 1985. I have experienced several booms and busts. This market is one that I wouldn’t have ever imagined. We have no real supply of homes. We dipped under 12,000 active homes in the beginning of June which is just not healthy. I have many clients that want to buy a home but it is hard to find one with this limited supply. I also have clients that want to sell, but they either don’t want to switch from a 3% loan rate to a 7% rate, or they are concerned they cannot find a home they like once they sell.

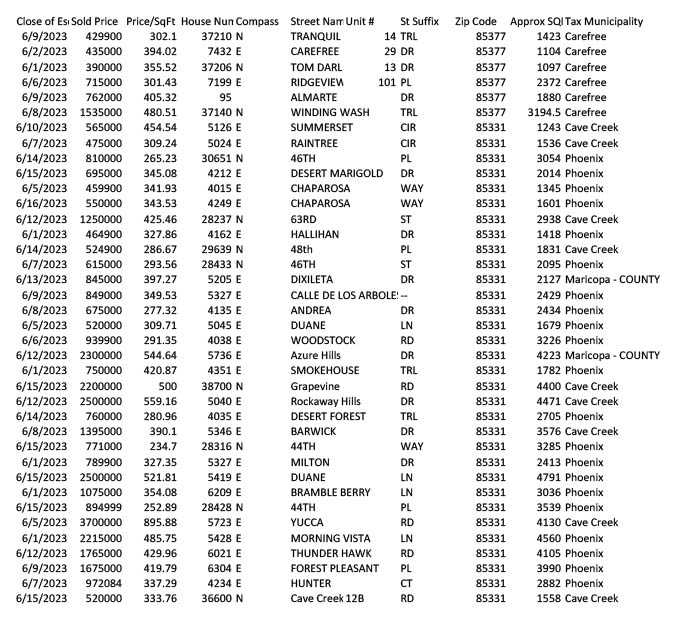

According to all the data I have seen, the values of homes are increasing.

I know many are thinking to wait until the interest rates go down. Will they? And when will that be? Historically, since I have been selling Real Estate, today’s rate at 7% isn’t really that unreasonable. Some think the values will skyrocket if the rates drop. What rate do they have to drop to for that to happen?

Other factors for the fluctuation of interest rates are Inflation, GDP, Employment, political power, to name a few.

With no crystal ball, it is hard to know the perfect timing for anything. If you buy now and rates go down, you can refinance. If rates go up, pat yourself on the back for your timing. Owning has so many more pros than leasing. You just have to dive in.