Guest Editorial

BY MENCKEN'S GHOST | JUNE 22, 2011

American v. European Taxes

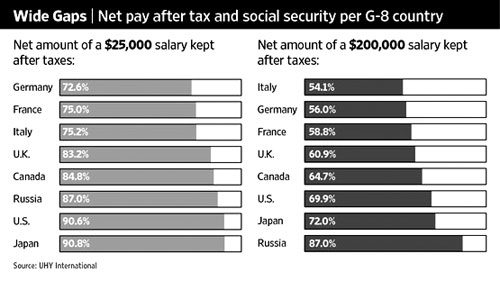

You know the lament from progressives, liberals, neo-Marxists and their fellow collectivists in the establishment media and academia: that richer Americans pay substantially less in income taxes than richer Europeans. Ah, but they don’t tell the other side of the story: that poorer Americans also pay substantially less in income taxes than poorer Europeans. For example, the percent of a $25,000 salary that remains after taxes in the USA is 90.6 percent, versus 72.6 percent in Germany.

You know the lament from progressives, liberals, neo-Marxists and their fellow collectivists in the establishment media and academia: that richer Americans pay substantially less in income taxes than richer Europeans. Ah, but they don’t tell the other side of the story: that poorer Americans also pay substantially less in income taxes than poorer Europeans. For example, the percent of a $25,000 salary that remains after taxes in the USA is 90.6 percent, versus 72.6 percent in Germany.

Warning: The more facts like this that you know, the more that you'll yell at your hometown newspaper and the television. Eventually you'll end up like me in a rubber room with spittle running down your chin.

Mencken’s Ghost

The Wall Street Journal, June 13, 2011

Europeans Found Taxed Heaviest

By Alistair MacDonald

Income in Western Europe remains the most heavily taxed in the world, while America's rich have heavier tax burdens than do America's poor when compared with their equivalents in other countries, according to a new survey.

Taxpayers in many European countries are likely to see little respite in the coming years, with levies already being raised by some governments as they tackle record debts built up over the financial crisis.

"Achieving a sustainable fiscal position will be difficult without raising taxes, which is a major political issue for many countries as they seek to strike a balance between fiscal responsibility and economic growth," said John Wolfgang, the chairman of UHY International, the London-based association of accounting and consulting firms that conducted the research.

The income tax and social-security contributions of those earning $200,000 a year was three times as great in the highest-taxed country, Italy, as in the lowest-taxed country, Russia, according to UHY International, which studied 19 countries. Dubai doesn't levy income tax at all, according to the survey.

Italians keep an average of 54.1% of a salary of $200,000, while Russians keep 87% of a similar wage, according to the survey.

Those earning $200,000 a year in the U.S. would typically keep 69.9% of their pay, which was the ninth-most-competitive rate in the survey. Those in the U.S. earning gross pay of $25,000, though, would keep 90.6% of their salary, the third-most-competitive rate.

Western European countries were seven of the top 10 highest taxed on salaries of $200,000. Israel's rich and India's poor were the highest non-European taxpayers of the 19 countries. (See graph below)

Still, income and social-security taxes don't provide a complete picture of how much money a country is taking in tax. In the U.S. state level income taxes can add another level of cost. Property and sales taxes vary hugely across the world. Also, Russian pay packets come off comparatively lightly because companies have to contribute social-security payments of up to 34% for every employee.

European nations typically levy higher taxes to fund generous social-security payments and public services. Europeans often argue that higher taxes provide better services such as health care, transport and education, and lower crime rates and corruption.

Still, some European countries are increasingly worried about high-earners moving abroad for tax purposes, and some European nations had been cutting taxes before the credit crunch. Finance professionals in London, for example, frequently threaten to move to lower-tax countries such as Switzerland and Ireland.

“Mencken’s Ghost” is the nom de plume of an Arizona writer who can be reached at [email protected].